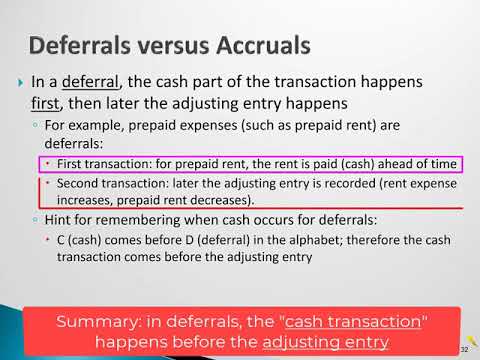

Deferrals, on the other hand, are often related to an expense that is paid in one period but is not recorded until a different period. Both accrual and deferral entries are very important for a company to give a true financial position. Moreover, both type adjusting entries help a business to comply with the matching concept of accounting. This is the payment of an expense incurred during a certain reporting period but is reported in another reporting period. An accrual system recognizes revenue in the income statement before it’s received.

Can you reverse deferrals?

If you have already reset interest accruals/deferrals, you must reverse the reset postings before you can reverse the interest accrual/deferral postings. If you have carried out a series of accrual/deferral runs using the difference procedure, the program can only reverse the last accrual/deferral run.

When considering cash flows, there are differences between deferred and accrued revenues. Deferred income involves receipt of money, while accrued revenues do not – cash may be received in a few weeks or months or even later. When you see a revenue listed in the income statement, it doesn’t mean that money was received. In December, the subscription totals will be accounted for as a deferred expense for Anderson Autos, because the products will not be delivered in the same accounting period they were paid for in. The magazine and newspaper companies will consider these amounts to be deferred revenue, because they haven’t actually incurred any expenses yet to produce the actual magazines, although they have been paid for them.

Examples of period expenses include advertising, marketing, sales and administration salaries and rent. Period expenses are expensed when incurred, because they cannot be traced to any particular product or service. The company should record both revenue and accounts receivable for $200 each. •An external cash flow is a flow of cash, securities, or assets that enter or exit a portfolio, which are generally client driven.

Period Expenses

After Pied Piper completes the second milestone and bills the client for $120,000, Pied Piper must record the following journal entry to reverse the initial accrual, and thereafter the second entry for the $120,000 invoice. Deferred revenue is unearned revenue and hence is treated as a liability. Accrued revenue is treated as an asset in the form of Accounts Receivables. In other words, it is the revenue earned/recognized by a business for which the invoice is yet to be billed to the customer.

- Deferred revenue is money received in advance for products or services that are going to be performed in the future.

- Matching will push the expense until the product sells and has revenues to match it.

- Cash accounting and accrual accounting are the two main ways you can approach your financials.

- Understanding what accruals are is only half the battle- knowing how to record accruals is an entirely different beast.

- Examples of unearned revenue are rent payments made in advance, prepayment for newspaper subscriptions, annual prepayment for the use of software, andprepaid insurance.

- Accrual expenses, on the other hand, are the payments that a company is supposed to make in the current financial year, but pays it another financial year.

A deferral involves either the receipt of cash before revenue has been earned or payment of cash before an expense is incurred. For example, if $1,000 of supplies were purchased on February 1, the proper accounting entries are a $1,000 debit entry to the supplies account and a $1,000 credit entry to the cash account. DateAccountDebitCreditApr-10Accounts Payable$750Cash$750To record payment on account.Note, in both examples above, the revenue or expense is recorded only once, and in the correct month. The second journal entry reflects the receipt or payment of cash to clear the account receivable or payable. An expense deferral is one where a payment was made before the accounting period, therefore, becoming an expense that is to be reported in the financial statements.

Difference Between Accrual And Deferral Accounting:

Investors like Lighter Capital, venture capitalists, and angels will take contracts with customers into consideration when evaluating the value of the company, although your bank probably won’t do so. Although accrual accounting is more complicated, it allows you to recognize revenue at the time that enables you to best match cash income with the expenses incurred while generating that income.

For a seller, revenue for a product is accounted for at the same time as its production costs are incurred. Now that you know what an accrual is, and you’ve read through a couple of examples, let’s get into deferrals. Accruals and deferrals are important accounting concepts to familiarize yourself with when running any business. Accruals are the items that occur before the actual payment and receipt.

What Is The Difference Between An Accrual And A Deferral?

For example, your business may enter into an agreement with a client to perform a service over a period of time. However, the client may pay you the entire amount for the service up front. If this occurs, you would enter the lump payment into a deferred revenue account and spread the revenue over the fiscal period. For instance, if a customer pays $100 upfront for two months of service, you would put the $100 into a deferred revenue account and subtract $50 from the account each month. Deferred revenue is a liability, such as cash received from a counterpart for goods or services that are to be delivered in a later accounting period.

These adjusting entries are depicted in the following tables with specific examples and journal entries. • On the contrary, deferral is recognition of receipts and payments after actual cash transactions. So in the case of deferral revenue you receive the cash but its recognition is done later. Deferred revenue is the recognition of receipts and payments after the actual cash transaction. Cash accounting and accrual accounting are the two main ways you can approach your financials.

Still Unsure? Step Inside And See What The Future Looks Like

“Revenue is best measured by the exchange value of the product or service of the enterprise….we still have the problem of deciding the point or points in time when we should measure and report the revenue…. In general agreement with view that revenue should be acknowledged and reported at the time of the accomplishment of the major economic activity if its measurement is verifiable and free from bias. •The aggregate return method, which combines all the composite assets and cash flows to calculate composite performance as if the composite were one portfolio, is acceptable as an asset-weighted approach. •Accrual accounting must be used for fixed-income securities and all other assets that accrue interest income. •For periods prior to 1 January 2001, portfolios must be valued at least quarterly. For periods between 1 January 2001 and 1 January 2010, portfolios must be valued at least monthly. For periods beginning 1 January 2010, firms must value portfolios on the date of all large external cash flows.

Debits increase asset or expense accounts and decrease liability, revenue or equity accounts. It will result in one business classifying the amount involved as a deferred expense, the other as deferred revenue. Understanding what accruals are is only half the battle- knowing how to record accruals is an entirely different beast. An accrual is recorded in a two-step process, which is a little different for revenues than it is for expenses. Let’s take a quick look at how to record accruals in your financial books. Under accrual accounting, you will record an employee’s wages as they are incurred instead of recording them when you pay them out.

Accruals Versus Cash Flows

Deferral, For example, Company XYZ receives $10,000 for a service it will provide over 10 months from January to December. In that scenario, the accountant should defer $9,000 from the books of account to a liability account known as “Unearned Revenue” and should only record $1,000 as revenue for that period.

Deferred expenses, also called prepaid expenses or accrued expenses, refer to expenses that have been paid but not yet incurred by the business. Common prepaid expenses may include monthly rent or insurance payments that have been paid in advance. Deferred revenue is money received in advance for products or services that are going to be performed in the future. Rent payments received in advance or annual subscription payments received at the beginning of the year are common examples of deferred revenue.

How To Determine Revenue From Unadjusted Trial Balances

For instance, if you plan to deliver a service worth $300 over three months in equal increments, you would divide the purchase amount up into thirds and record of the purchase price ($100) in each pay period. When a company purchases an asset on credit, even though payments will be made later on to the credit card company, that purchase should be recorded immediately. A deep understanding of accruals is necessary for proper financial reporting. So, we will begin by taking a close look at the definition of accruals and a few examples. Under deferral, there is an increase in expenses and a decrease in revenue. Accrual expenses, on the other hand, are the payments that a company is supposed to make in the current financial year, but pays it another financial year.

When you prepay expenses — for rent or other items — the entire sum is taken from your assets. For example, if you pay $6,000 for six months of rent upfront, you put the $6,000 into a deferred expense account and debit the account $1,000 each month for six months.

How To Record A Note Payable With No Cash Deposit

Deferred revenue is sometimes also known as unearned revenue which is not earned by the company yet. The company owes goods or services to the customer, but the cash has been received in advance. A Deferred expense or prepayment, prepaid expense, plural often prepaids, is an asset representing cash paid out to a counterpart for goods or services to be received in a later accounting period. For example, if a service contract accrual vs deferral is paid quarterly in advance, at the end of the first month of the period two months remain as a deferred expense. In the deferred expense the early payment is accompanied by a related recognized expense in the subsequent accounting period, and the same amount is deducted from the prepayment. The adjusting entries for accruals and deferrals will always involve an income statement account and a balance sheet account.

A deferral of revenues refers to receipts in one accounting period, but they will be earned in future accounting periods. For example, the insurance company has a cash receipt in December for a six-month insurance premium. However, the insurance company will report this as part of its revenues in January through June. Buyers and sellers would be wise to work together and bring more certainty to their intended tax treatment for unearned revenue for purposes of both tax and target working capital. In the company’s financial statements, this would be reported under unearned amount, which will be a liability until the company provides these services and earns money.

An accrued expense is recognized on the books before it has been billed or paid. Accrued revenue—an asset on the balance sheet—is revenue that has been earned but for which no cash has been received. Used when income is received this fiscal year for services or goods to be provided next fiscal year.