It has debit and credit columns to record the balances extracted from ledger accounts with a view to test the arithmetical accuracy of the books of accounts. While the definition of the document is relatively straightforward, you’re probably thinking – what is the purpose of the adjusted trial balance? Well, the purpose of preparing an adjusted trial balance is to ensure that the financial statements for the period are accurate and up-to-date. It corrects any errors to make the statements compatible with the requirements of an applicable accounting framework. You can use the report to analyze end-of-period performance and it is often applied when creating closing entries, which are journal entries to transfer temporary accounts to permanent accounts. If you fail to make a journal entry or record a financial transaction in an incorrect account, it will not show up as an error in the trial balance. Numbers transposed in the debit column instead of in the credit column, also will not show up in the trial balance.

² In accrual accounting, revenue and expenses are recorded when they are earned or incurred irrespective of whether the cash is exchanged or not. A post-closing trial balance is done after preparing and posting your closing entries. This trial balance, which should contain only balance sheet accounts, will help guarantee that your books are in balance for the beginning of the new accounting period.

It is generally a statement that represents the total of debits and credits of all your ledger accounts. You prepare such a statement to verify the arithmetical accuracy of posting various journal entries in your ledger accounts.

It gives you a snapshot of the accounting transactions of your business to the accountants and auditors. What do you do if you have tried both methods and neither has worked? Unfortunately, you will have to go back through one step at a time until you find the error. This meant they would review statements to make sure they aligned with GAAP principles, assumptions, and concepts, among other things.

They are thus able to provide their comments with regards to the financial statements so prepared in the audit report. For instance, in our vehicle sale example the bookkeeper could have accidentally debited accounts receivable instead of cash when the vehicle was sold.

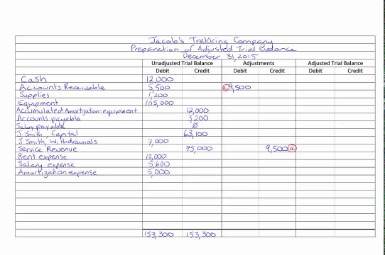

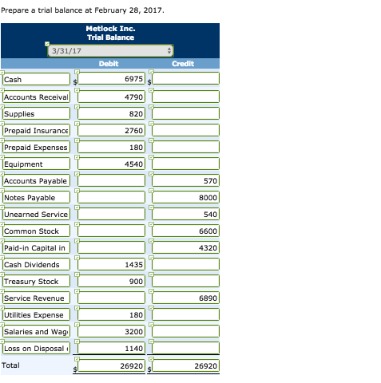

After posting all transactions from an accounting period, accountants prepare a trial balance to verify that the total of all accounts with debit balances equals the total of all accounts with credit balances. The trial balance lists every open general ledger account by account number and provides separate debit and credit columns for entering account balances. The Greener Landscape Group’s trial balance for April 30,20X2 appears below. You prepare an adjusted trial balance to verify the accuracy of posting into the general ledger accounts. Thus, an adjusted trial balance is the second trial balance in the accounting process. You prepare such a statement to verify whether the debit balances of accounts equate to their credit balances. Once you prepare the adjusted trial balance, the balances of some of the items in the unadjusted trial balance would change.

Step 2: Enter Adjusting Journal Entries

After all transactions have been posted from the journal to the ledger, it is a good practice to prepare a trial balance. A trial balance is simply a listing of the ledger accounts along with their respective debit or credit balances. The trial balance is not a formal financial statement, but rather a self-check to determine that debits equal credits. To set up an unadjusted trial balance, create a table with three columns using a sheet of paper or spreadsheet program. Label the first column “Accounts.” This column includes each account name in the general ledger. The second column is the “Debit” column and shows the balance of the accounts with debit balances. The rightmost column is the “Credit” column, which shows the balances of accounts with credit balances.

What is journal in accounts?

A journal is a detailed account that records all the financial transactions of a business, to be used for the future reconciling of accounts and the transfer of information to other official accounting records, such as the general ledger.

While using accounting software drastically reduces the need for the trial balance report, these reports can still be useful in many ways. After you finish entering all of the balances from your ledgers, you will need to add them up to ensure that both the debit and credit columns balance. Applicant Tracking Choosing the best applicant tracking system is crucial to having a smooth recruitment process that saves you time and money. Find out what you need to look for in an applicant tracking system. Appointment Scheduling Taking into consideration things such as user-friendliness and customizability, we’ve rounded up our 10 favorite appointment schedulers, fit for a variety of business needs. Business Checking Accounts Business checking accounts are an essential tool for managing company funds, but finding the right one can be a little daunting, especially with new options cropping up all the time. CMS A content management system software allows you to publish content, create a user-friendly web experience, and manage your audience lifecycle.

Venmo Business Account: What You Need To Know About Venmo For Business

Due to the outcome of this type of error, the credit side in the trial balance will be $ 50 to become higher because the sales account will appear at the higher figure on the credit side in the trial balance. This error may also be neutralized by over posting of $ 500 on the debit side in some other account or accounts.

After posting all financial transactions to the accounting journals and summarizing them in the general ledger, a trial balance is prepared to verify that the debits equal the credits on the chart of accounts. It is the first step in the “end of the accounting period” process. Unadjusted trial balance is an important step towards preparing a complete set of financial statements. It summarizes all the ledger accounts balances in one statement. ¹ You will get an overview of all the accounts that are used in your business for example, sales account, purchase account, inventory account etc. in a summary form with the help of an unadjusted trial balance. If the difference between the debit and credit balance totals is not divisible by 2 or 9, look for a ledger account with a balance that equals the difference and is missing from the trial balance.

Sage 50cloud is a feature-rich accounting platform with tools for sales tracking, reporting, invoicing and payment processing and vendor, customer and employee management. Get clear, concise answers to common business and software questions.

The trial balance is a business entity’s first attempt to balance its books when an accounting period ends. It takes the ending balances from each general ledger account. If done properly, the debit side of the trial balance will equal the credit side. If they don’t equal, then some investigation needs to happen to find the error so the accounting process can continue. The purpose of a trial balance is to prove that the value of all the debit value balances equals the total of all the credit value balances. If the total of the debit column does not equal the total value of the credit column then this would show that there is an error in the nominal ledger accounts.

Listing Balance Sheet Accounts

Furthermore, a trial balance also includes the account number of each of the general ledger accounts. In addition to this, your trial balance sheet also showcases the name of your entity in the title and the date of the financial period for which such a statement is prepared. The very objective of preparing a trial balance is to determine whether all your debit or credit entries are recorded properly in the ledger. Thus, it provides the summary of your general ledger accounts as it showcases the accounts and their balances.

If the debits and credits do not equal, see if the number 2 divides equally into the difference. If it does, look for an account, look for an account incorrectly in the column with the larger total that equals half the difference. The next step is to add up the amount of debit column and credit column respectively. If their sums are equal, the trial balance is error-free, and you may close it. Trial balance is a useful accounting tool for the accounting process of listing ledger accounts along with their respective credit or debit accounts. The purpose of doing this is to determine the balance between credit and debit amounts on record.

Basically, each one of the account balances is transferred from the ledger accounts to the trial balance. All accounts with debit balances are listed on the left column and all accounts with credit balances are listed on the right column.

- After the all the journal entries are posted to the ledger accounts, the unadjusted trial balance can be prepared.

- It is important to go through each step very carefully and recheck your work often to avoid mistakes early on in the process.

- These adjustments are usually for accrual entries to either defer or accelerate the recognition of expenses.

- The equality of the two totals in the trial balance does not necessarily mean that the accounting process has been error-free.

- These decisions may be regarding your manufacturing costs, business expenses, incomes, etc.

In addition, an adjusted trial balance is used to prepare closing entries. The equality of the two totals in the trial balance does not necessarily mean that the accounting process has been error-free. Serious errors may have been made, such as failure to record a transaction, or posting a debit or credit to the wrong account. For instance, if a transaction involving payment of a $ 100 account payable is never recorded, the trial balance totals still balance, but at an amount that is $ 100 too high. At the end of the financial year, the balances of all the ledger accounts are extracted.

Errors In Trial Balance

The purpose of a trial balance is to ensure that all debit transactions entered into the general ledger equal all of the credit transactions that have been entered. Add titles to the fifth and sixth columns of the worksheet, which are for adjusting debits and trial balance adjusting credits. These adjustments are usually for accrual entries to either defer or accelerate the recognition of expenses. If the column totals do not match, it means that there should be an accounting error, and it is an unadjusted trial balance.

As with theaccounting equation, these debit and credit totals must always be equal. If they aren’t equal, the trial balance was prepared incorrectly or the journal entries weren’t transferred to the ledger accounts accurately. The first accounts to include in the table are your assets, such as cash and inventory. After your assets come your liabilities, such as accounts payable, and stockholders’ equity accounts, such as common stock. Assets, liabilities and equity accounts make up your balance sheet. For instance, you may record an equal debit and credit of an incorrect amount. Thus, such an error would result in two accounts with incorrect balances.

Alternatives Looking for a different set of features or lower price point? Check out these alternative options for popular software solutions. Business Checking Accounts BlueVine Business Checking The BlueVine Business Checking account is an innovative small business bank account that could be a great choice for today’s small businesses. Appointment Scheduling 10to8 10to8 is a cloud-based appointment scheduling software that simplifies and automates the process of scheduling, managing, and following up with appointments. Disbursement is the act of paying out or disbursing money, which can include money paid out for a loan, to run a business, or as dividend payments. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

How Does A Trial Balance Work?

The following video summarizes what elements are included in a Trial Balance and why one is prepared. The trial balance is the edit phase of our story before we publish the results in financial statements. After including all the assets, then liabilities and stockholders’ equity accounts are included in the trial balance. A trial balance only checks the sum of debits against the sum of credits. The following are the main classes of errors that are not detected by the trial balance. Thus, you must treat the amount spent on any addition made to the land and building as a capital expenditure. However, you may wrongly treat it as a revenue expense if you debit the maintenance and repairs account with such an amount.

Today’s accounting software can print a trial balance at the click of a mouse. Further, a computerized accounting system has eliminated the many math and clerical errors that had occurred with a manual accounting system. The debit and credit columns of trial balance have been correctly totaled. Managers and accountants can use this trial balance to easily assess accounts that must be adjusted or changed before the financial statements are prepared. QuickBooks Desktop was one of the first accounting software applications to replace common accounting terms such as accounts payable and accounts receivable with more familiar terms such as bills and money owed. As you can see by the adjusted trial balance example above, some of the account totals have now been updated. In this example, the adjusted trial balance shows the changes that affected both the rent and depreciation accounts.

However, you tend to commit an error of principle if you ignore or violate any of these accounting principles. For instance, you may commit an error of principle if you incorrectly classify an expenditure or a receipt between capital and revenue accounts. Committing such an error would certainly impact your financial statements.

As mentioned earlier, you prepare a Trial Balance Sheet to check the arithmetical accuracy of your ledger accounts. To ascertain the accuracy of various ledger accounts, you need to locate errors and in return rectify such errors.