What are Unsecured Bonds?

What is the difference between a bond and a note payable?

Bonds payable that mature (or come due) within one year of the balance sheet date will be reported as a current liability if the issuer of the bonds must use a current asset or will create a current liability in order to pay the bondholders when the bonds mature. This type of investment is known as a bond sinking fund.

The durability of cash means that even when metal coins melt in a fireplace or are submerged beneath the sea for lots of of years they nonetheless have some worth when they are recovered. Gold cash salvaged from shipwrecks retain nearly all of their original look, however silver cash slowly corrode. Generally, a central financial institution or treasury is solely accountable within a state or currency union for the issue of banknotes. However, this is not always the case, and traditionally the paper forex of countries was typically dealt with completely by non-public banks. Thus, many various banks or institutions might have issued banknotes in a given country.

However, rare banknotes nonetheless promote for a lot less than comparable uncommon cash. A few uncommon and historical banknotes have offered for greater than one million dollars. The first brief-lived try at issuing banknotes by a central financial institution was in 1661 by Stockholms Banco, a predecessor of Sweden’s central bank Sveriges Riksbank. These changed the copper-plates getting used instead as a means of cost.

Banknote amassing, or notaphily, is a slowly growing area of numismatics. Although usually not as widespread as coin and stamp accumulating, the pastime is slowly expanding. Prior to the introduction of banknotes, valuable or semiprecious metals minted into coins to certify their substance were extensively used as a medium of change.

For years, the mode of accumulating banknotes was via a handful of mail order sellers who issued price lists and catalogs. In the early Nineteen Nineties, it became more widespread for uncommon notes to be sold at various coin and forex shows via public sale. The illustrated catalogs and “occasion nature” of the auction practice seemed to gas a sharp rise in total awareness of paper cash in the numismatic community.

Is Bonds Payable an asset?

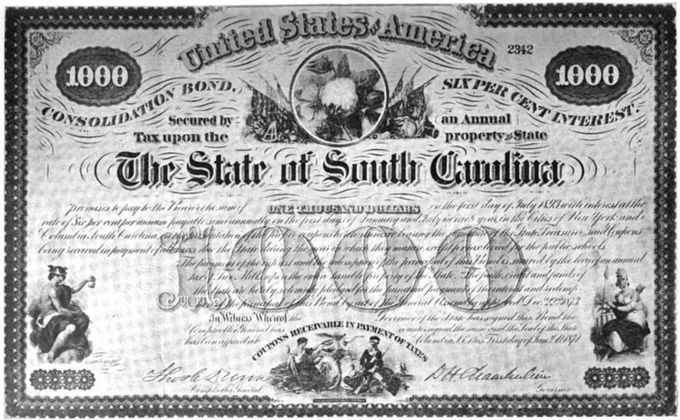

Bonds payable are a form of long term debt usually issued by corporations, hospitals, and governments. The issuer of bonds makes a formal promise/agreement to pay interest usually every six months (semiannually) and to pay the principal or maturity amount at a specified date some years in the future.

Example of Bonds Payable

Commercial banks within the United States had legally issued banknotes earlier than there was a national forex; however, these grew to become topic to government authorization from 1863 to 1932. In the last of those series, the issuing financial institution would stamp its title and promise to pay, together with the signatures of its president and cashier on a preprinted note. By this time, the notes were standardized in appearance and not too completely different from Federal Reserve Notes.

Until the mid-nineteenth century, industrial banks had been able to concern their very own banknotes, and notes issued by provincial banking corporations were the widespread form of foreign money all through England, outside London. The Bank Charter Act of 1844, which established the trendy central financial institution, restricted authorisation to concern new banknotes to the Bank of England, which might henceforth have sole management of the cash supply in 1921.

T-notes are issued by the U.S. government when it goals to generate funds to pay down money owed, undertake new tasks, or enhance infrastructure, for the advantage of the nation and the general economy. The notes, which are offered in $100 increments, pay interest in six-month intervals and pay investors the complete face value of the observe, upon maturity. Banknotes have a natural advantage over coins in that they are lighter to carry however are additionally less durable. Banknotes issued by industrial banks had counterparty risk, meaning that the bank could not be able to make fee when the observe was introduced. Notes issued by central banks had a theoretical risk when they had been backed by gold and silver.

Bond Interest Payments

- For years, the mode of collecting banknotes was by way of a handful of mail order sellers who issued price lists and catalogs.

- In the early Nineties, it became extra widespread for rare notes to be offered at numerous coin and forex shows through public sale.

- The illustrated catalogs and “occasion nature” of the auction follow appeared to gas a sharp rise in general awareness of paper cash in the numismatic community.

The very highest quality bonds are referred to as “funding grade” and embrace debt issued by the U.S. government and very stable companies, like many utilities. Bonds that are not thought of investment grade, however usually are not in default, are called “excessive yield” or “junk” bonds. These bonds have a higher threat of default in the future and investors demand the next coupon payment to compensate them for that threat. Treasury notes, commonly known as T-notes, are monetary securities that usually have longer phrases than Treasury payments, but shorter phrases than Treasury bonds.

The worth that people attributed to coins was initially based upon the value of the metallic unless they have been token points or had been debased. They now make up a really small proportion of the “money” that people assume that they’ve as demand deposit financial institution accounts and digital funds have negated the necessity to carry notes and coins. The first financial institution to provoke the permanent concern of banknotes was the Bank of England. Established in 1694 to raise cash for the funding of the struggle in opposition to France, the bank started issuing notes in 1695 with the promise to pay the bearer the value of the observe on demand. They were initially handwritten to a precise amount and issued on deposit or as a loan.

This banknote concern was led to by the peculiar circumstances of the Swedish coin supply. Cheap foreign imports of copper had forced the Crown to steadily improve the scale of the copper coinage to keep up its value relative to silver. The heavy weight of the new cash inspired merchants to deposit it in exchange for receipts.

Accounting for bonds

At the identical time, the Bank of England was restricted to problem new banknotes provided that they were one hundred% backed by gold or up to £14 million in authorities debt. The Act gave the Bank of England an effective monopoly over the notice concern from 1928. A senior notice is a type of bond that takes priority over other money owed within the event that the company declares chapter and is pressured into liquidation. Because they carry a lower diploma of risk, senior notes pay decrease charges of curiosity than junior bonds.

Note

These grew to become banknotes when the manager of the Bank decoupled the rate of observe problem from the bank forex reserves. Three years later, the financial institution went bankrupt, after rapidly rising the bogus cash provide by way of the massive-scale printing of paper money. A new bank, the Riksens Ständers Bank was established in 1668, however didn’t problem banknotes until the nineteenth century. The shift toward the usage of these receipts as a method of cost took place within the mid-17th century, as the price revolution, when comparatively rapid gold inflation was inflicting a re-evaluation of how money worked. The goldsmith bankers of London began to provide out the receipts as payable to the bearer of the document quite than the unique depositor.

They’re each debt, but they are not the identical. Here’s the place they differ.

The central authorities quickly observed the financial benefits of printing paper money, issuing a monopoly proper of several of the deposit outlets to the issuance of those certificates of deposit. By the early twelfth century, the quantity of banknotes issued in a single yr amounted to an annual fee of 26 million strings of money cash. By the 1120s the central government formally stepped in and produced their own state-issued paper money (utilizing woodblock printing). Credit rankings for an organization and its bonds are generated by credit rating companies like Standard and Poor’s, Moody’s, and Fitch Ratings.

This meant that the note could be used as currency based on the safety of the goldsmith, not the account holder of the goldsmith-banker. The bankers also began issuing a larger value of notes than the entire worth of their bodily reserves in the type of loans, on the idea that they’d not need to redeem all of their issued banknotes on the same time. This pivotal shift modified the straightforward promissory observe into an company for the expansion of the monetary supply itself. As these receipts have been more and more used within the money circulation system, depositors started to ask for a number of receipts to be made out in smaller, fixed denominations for use as cash. The receipts soon grew to become a written order to pay the amount to whoever had possession of the observe.

The emergence of forex third party grading providers (just like companies that grade and “slab”, or encapsulate, cash) additionally may have increased collector and investor curiosity in notes. Entire advanced collections are often bought at one time, and to this day single auctions can generate tens of millions in gross sales. Today, eBay has surpassed auctions when it comes to highest quantity of gross sales of banknotes.