What is accrued curiosity?

It offers an outline of cash owed and credit score given, and permits a enterprise to view upcoming revenue and bills in the following fiscal interval. Companies must account for expenses they have incurred up to now, or which will come due in the future.

It is classed as an intangible asset on the balance sheet, since it could possibly neither be seen nor touched. Under US GAAP and IFRS, goodwill is never amortized, as a result of it’s thought of to have an indefinite useful life. Instead, management is liable for valuing goodwill every year and to determine if an impairment is required. If the honest market worth goes beneath historical price (what goodwill was purchased for), an impairment have to be recorded to deliver it all the way down to its fair market worth.

However, a rise in the honest market value wouldn’t be accounted for within the monetary statements. Private firms in the United States, however, may elect to amortize goodwill over a interval of ten years or less beneath an accounting alternative from the Private Company Council of the FASB. Similarly, a salesperson, who sold the product, earned a commission at the moment of sale (or delivery).

Accrual accounting is a method of monitoring such accumulated payments, both as accrued bills or accounts payable. Accrued bills are these liabilities which have constructed up over time and are as a result of be paid.

Examples of identifiable property that are goodwill include a company’s brand name, customer relationships, inventive intangible assets, and any patents or proprietary know-how. The goodwill amounts to the surplus of the “buy consideration” (the cash paid to purchase the asset or business) over the online worth of the assets minus liabilities.

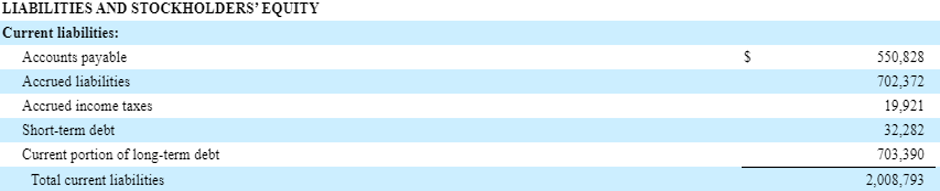

Accounts payable, on the other hand, are current liabilities that shall be paid within the near future. Below, we go into a bit extra detail describing each sort of steadiness sheet merchandise.

Goodwill in accounting is an intangible asset that arises when a purchaser acquires an present business. Goodwill represents assets that are not separately identifiable.

The key difference between these terms is that accrued expense is acknowledged within the accounting books for the interval it’s incurred in whether or not money is paid or not. Accounts payable is the cost to collectors who have made gross sales to the corporate on credit score.

As a result, if anyone appears on the steadiness within the accounts payable class, they may see the entire amount the enterprise owes all of its vendors and quick-time period lenders. When the expense is paid, the account payable liability account decreases and the asset used to pay for the liability also decreases. For instance, a company delivers a product to a customer who can pay for it 30 days later in the next fiscal 12 months, which starts a week after the delivery. The company recognizes the proceeds as a income in its present revenue assertion still for the fiscal yr of the supply, although it will not receives a commission until the next accounting period.

Where does accrued expense payable?

Accrual and account payable refer to accounting entries in the books of a company or business. Accruals refer to earned revenues and incurred expenses that have not actually been realized. Accounts payable are short-term debts, representing goods or services a company has received but not yet paid for.

Both accrual and account payable are accounting entries that appear on a enterprise’ income statements and balance sheets. An account payable is a legal responsibility to a creditor that denotes when an organization owes money for items or providers.

- Accruals form the bottom for accrual accounting and incorporate all transactions, including accounts receivable, accounts payable, employee salaries, and so on.

- In a money-primarily based accounting strategy, an organization data solely the transactions where cash changes palms.

- The use of accruals allows a business to look past easy money move.

accrued bills payable definition

Is an accrual a payable?

accrued expenses payable definition. A liability account that reflects the estimated amount a company owes for expenses that occurred, but have not yet been paid nor recorded through a routine transaction.

These types of accounts include, amongst others, accounts payable, accounts receivable, goodwill, deferred tax liability and future interest expense. Accrued expenses and accounts payable are two necessary phrases recorded in the balance sheet of organizations.

Accrued Expense vs. Accrued Interest: What’s the Difference?

The use of accruals allows a business to look past easy cash move. In a money-based mostly accounting approach, an organization data solely the transactions the place money modifications palms.

Accrual (accumulation) of something is, in finance, the adding collectively of interest or totally different investments over a period of time. It holds specific meanings in accounting, where it could possibly check with accounts on a steadiness sheet that characterize liabilities and non-money-primarily based assets utilized in accrual-based accounting.

Accrual

The most typical types of accrued revenues recorded on monetary statements are interest income and accounts receivable. Interest revenue is money earned from investments, while accounts receivable is money owed to a enterprise for items or services that have not been paid for yet. Accrued revenues and accrued bills are both integral to financial assertion reporting as a result of they help give the most correct monetary image of a enterprise.

The proceeds are also an accrued earnings (asset) on the balance sheet for the delivery fiscal 12 months, but not for the following fiscal yr when money is received. Accrued revenues are revenues earned in one accounting period but not received until one other.

Accruals kind the base for accrual accounting and incorporate all transactions, together with accounts receivable, accounts payable, employee salaries, etc. Recording an amount as an accrual provides a company with a extra comprehensive take a look at its monetary state of affairs.

Goodwill also does not embrace contractual or other legal rights no matter whether or not those are transferable or separable from the entity or different rights and obligations. Goodwill is also only acquired via an acquisition; it cannot be self-created.

When are expenses and revenues counted in accrual accounting?

Accounts payable (AP), generally referred merely to as “payables,” are an organization’s ongoing expenses which might be typically quick-time period money owed which have to be paid off in a specified interval to keep away from default. They are considered to be current liabilities as a result of the cost is usually due within one year of the date of the transaction. Accounts payable are acknowledged on the steadiness sheet when the corporate buys goods or providers on credit score. Under the accrual accounting method, when an organization incurs an expense, the transaction is recorded as an accounts payable liability on the steadiness sheet and as an expense on the earnings assertion.