Why Would a Cash Account Have a Credit Balance?

We now provide eight Certificates of Achievement for Introductory Accounting and Bookkeeping. The certificates include Debits and Credits, Adjusting Entries, Financial Statements, Balance Sheet, Cash Flow Statement, Working Capital and Liquidity, And Payroll Accounting. Cash is an account utilized in accounting that has a traditional debit steadiness. Accounting is done utilizing a double-entry technique utilizing debits and credit.

(See #1 within the T-account above.) In our second transaction, the enterprise spent $3,000 of its money to purchase tools. Hence, merchandise #2 in the T-account was a credit of $three,000 to be able to cut back the account stability from $5,000 all the way down to $2,000. Referred to because the “one-write” system, this time-saver also reduces the prospect of posting errors.

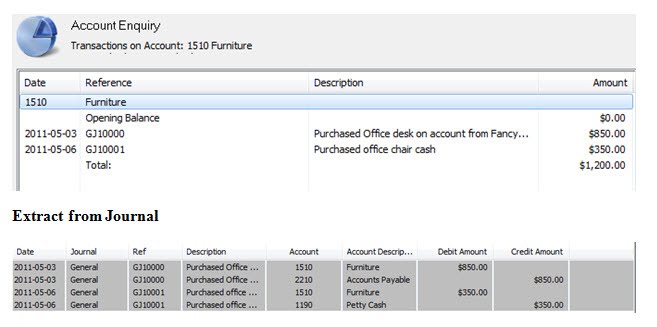

A journal entry is used to report a business transaction within the accounting data of a business. A journal entry is normally recorded in the common ledger; alternatively, it could be recorded in a subsidiary ledger that’s then summarized and rolled ahead into the overall ledger.

The account titles are found on the enterprise’ general ledger, which is a running listing of all these transactions. When compiled by an accountant, the final ledger accounts mix to form the corporate’s monetary statements. Equipment is a noncurrent or long-time period asset account which stories the price of the equipment. The logic behind a journal entry is to record every enterprise transaction in at least two locations (generally known as double entry accounting). For instance, when you generate a sale for money, this will increase each the income account and the cash account.

Credit purchases and funds on account are entered in these two columns, respectively. At the end of the month they’re totaled and posted to the control account within the basic ledger. Accountants should look previous the form and concentrate on the substance of the transaction. Liabilities are obligations of the corporate; they’re quantities owed to creditors for a past transaction they usually often have the phrase “payable” in their account title.

Real Accounts vs. Nominal Accounts: Definition, Differences & Examples

Therefore, the Cash account is elevated with a debit entry of $2,000; and the Accounts Receivable account is decreased with a credit entry of $2,000. The general ledger contains an accounts payable account, which is your accounts payable control account. The money disbursements journal has accounts payable credit score and debit columns.

A actual account is an account that will always be a part of a company’s books as soon as opened. It’s there from the very first business day to the final business day. Most of the true accounts show up on an organization’s stability sheet.

Long-time period Assets

They could be current liabilities, such as accounts payable and accruals, or long-time period liabilities, corresponding to bonds payable or mortgages payable. In an accounting journal, debits and credits will always be in adjacent columns on a page. Entries are recorded in the relevant column for the transaction being entered. In reality, accounting transactions are recorded by making accounting journal entries. Just like everything else in accounting, there’s a particular approach to make an accounting journal entry when recording debits and credits.

Cash Account

Cash, accounts receivable, accounts payable, notes payable and proprietor’s fairness are all actual accounts that are discovered on the steadiness sheet. When a company prepares its stability sheet, a adverse stability in the money account ought to be reported as a present liability which it’d describe as checks written in excess of money stability. The logic is that the company doubtless issued the checks to scale back its accounts payable. Since the issued checks is not going to be paid by the company’s bank, the corporate still has the liability. Since assets are on the left side of the accounting equation, each the Cash account and the Accounts Receivable account are anticipated to have debit balances.

The balance sheet is the financial assertion that lists all of the accounts that a company has and their balances. For instance, let’s say a enterprise pays cash to purchase new inventory from its suppliers. The bookkeeper credits (provides) the stock account on the final ledger for the price of that new stock. That updates the books to show that new inventory has been purchased and is now owned by the corporate.

- The certificates embody Debits and Credits, Adjusting Entries, Financial Statements, Balance Sheet, Cash Flow Statement, Working Capital and Liquidity, And Payroll Accounting.

- We now offer eight Certificates of Achievement for Introductory Accounting and Bookkeeping.

The balances of actual accounts accrue over the lifetime of the company. Accounts receivable could be a little fun—after all, it’s all about raking in your hard-earned dough. Accounts payable (usually known as A/P), however, focuses on the unpaid payments of the enterprise—that’s, the cash you owe your suppliers and other creditors. The sum of the quantities you owe to your suppliers is listed as a current liability on your steadiness sheet.

Debits and credits kind the premise of the double-entry accounting system. Without understanding how they work, it becomes very troublesome to make any entries to an organization’s general ledger.

The money account represents how a lot money the corporate has on hand or in its bank accounts. Real accounts, like cash, accounts receivable, accounts payable, notes payable, and proprietor’s equity, are accounts that, once opened, are always part of the corporate. Real accounts show up on a company’s stability sheet, which is the financial statement that lists all the accounts that an organization has and their balances.

It’s the actual accounts that show the property, liabilities and proprietor’s fairness in a company. I bet you’d wish to have a number of examples of real accounts, would not you?

Each day, the credit gross sales recorded within the sales and money receipts journal are posted to the appropriate buyer’s accounts within the accounts receivable ledger. This allows you to know not solely the entire amount owed to you by all credit customers, but in addition the entire quantity owed by eachcustomer. Liabilities are objects on a steadiness sheet that the company owes to vendors or monetary establishments.

What type of account is a cash account?

Cash Account. A cash account is a brokerage account in which a customer is required to pay the full amount for securities purchased, and buying on margin is prohibited.

Asset Accounts

Is a cash account an asset?

Current Assets Cash – Cash is the most liquid asset a company can own. It includes any form of currency that can be readily traded including coins, checks, money orders, and bank account balances. Accounts Receivable – Accounts Receivable is an asset that arises from selling goods or services to someone on credit.

Or, if you purchase goods on account, this will increase each the accounts payable account and the inventory account. Goodwill is calculated and categorized as a set asset in the balance sheets of a business.

Types of Asset Accounts – Explanation

Along with owner’s fairness, liabilities can be thought of as a source of the company’s assets. They may also be regarded as a claim towards an organization’s property. For instance, an organization’s stability sheet reviews property of $one hundred,000 and Accounts Payable of $40,000 and proprietor’s fairness of $60,000. The supply of the company’s assets are collectors/suppliers for $forty,000 and the owners for $60,000. The creditors/suppliers have a claim in opposition to the company’s property and the owner can claim what stays after the Accounts Payable have been paid.

The common ledger is then used to create financial statements for the enterprise. Since Cash is an asset account, its regular or anticipated stability will be a debit steadiness. Therefore, the Cash account is debited to increase its steadiness. In the first transaction, the company increased its Cash balance when the proprietor invested $5,000 of her personal cash within the enterprise.